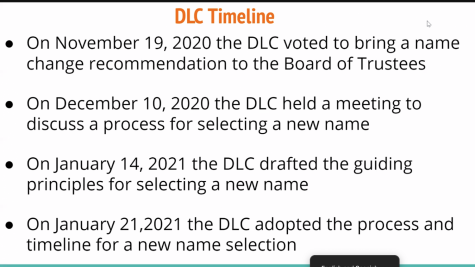

California Ballot Measures

The SMART Train at the San Rafael station.

Measure B – Didn’t Pass

2/3 needed to pass – 60% Yes

Measure B is the renewal of special funding for the Tamalpais Union High School District. The measure would renew a parcel tax of $455 but adds an additional $190 per parcel as well. A total of $23 million would be going to the school district annually to “maintain high quality education,” according to marincounty.org.

“Measure B renews and increases expiring local funding and prevents devastating cuts equivalent to laying off 114 teachers,” argued proponents of the measure.

Proponents continue to argue in favor of the measure citing the opportunities for exemption. TUHSD also touts its AAA credit-rating as an example of fiscal responsibility.

“Measure B forces a studio condo owner to pay as much as the mall,” exclaimed opponents to the measure.

They list eventual enrollment decline, unnecessary extra taxation, and district reneges as reasons to vote no.

Since the measure requires a two-thirds majority to pass, the district has to convince Marinites that the money can be used effectively. Last year, the district downsized its staff via early retirement opportunities and general dismissals. They now ask for extra funds so that they can avoid having to downsize again.

Caption: competing signs state positions on Measure B at Magnolia and Estelle Ave in Kentfield near College of Marin.

Measure D – Didn’t Pass

Majority needed to pass – 58% No

Measure D mandates that any change to the San Geronimo Valley Golf Course must have voter approval and requires the county to undertake an economic and environmental analysis of the property for any change, not golf-related. According to the Marin Voter Information Guide, change to the golf course would constitute “landscape modifications or changes associated with the termination of use.” The Trust for Public Land (TPL) planned to purchase the golf course in 2018 for $8.5 million, but the county court ordered an environmental review on the land, putting the deal on hold.

Supporters claim the measures will ensure public accountability, calling the county’s dealings with the TPL backroom. Only three county supervisors made this decision and went against the San Geronimo Valley Community Plan written in 1997. Additionally, the reappropriation of property for use beside a golf course would cost the employment of 30 people and lost tax revenue.

Opponents to the measure assert the bill trades public usage of the land for the single use of golf. The measure will block wildlife conservation efforts, improvements to the West Marin water quality, the construction of hiking trails, and the creation of a critically new fire department headquarters. Measure D would also bring all local community plans to a countywide vote.

Measure I – Didn’t Pass

2/3 needed to pass – 53% Yes

The Sonoma-Marin Area Transit (SMART) is on the ballot in March, Measure I would extend the pre-existing quarter cent sales tax for an additional 30 years. The tax was first approved in 2008 for construction of the train. The SMART board now asks voters to continue the tax so they can continue to maintain a, “world class transportation system.”

Opponents to the SMART report that four out of five riders of the train are Sonoma Residents. They also argue that SMART has not reduced greenhouse gas pollution and that the SMART board “doesn’t even try to substantiate those claims.”

SMART on the other hand reports over 1.6 million riders, including nearly 6,000 passengers who require wheelchair access. The SMART board also states its success in the construction of the train despite “serious obstacles.”

The debate on Measure I all comes to a head on March 3, when the voters will decide whether to continue the tax or do away with it. Marin County may very well decide the fate of the SMART train.

Measure C – Pass

2/3 needed to pass – 67% Yes

The Marin Wildfire Prevention Measure, or Measure C, is a bill that gives funding to the Marin Wildfire Prevention Authority (MWPA). MWPA is composed of 17 agencies based all over the county, from Novato to Stinson. According to marincounty.org, the measure focuses on wildfire “early detection, warning and alerts; reducing vegetation; ensuring defensible space around homes, neighborhoods and critical infrastructure; and improving disaster evacuation routes.”

A parcel tax will fund the measure, 10 cents per every building square foot, and $75 per multifamily resident. The tax will come into effect in July, lasting for ten years and expected to bring in $19.3 million every year. The tax’s annual increase will be no more than 3 percent, adjusted for inflation.

Supporters of Measure C worry about the extended fire season’s danger to Marin. They say Marin has an identical fire risk to the 2017 Sonoma County fire, according to the study by the Marin County Fire Department, “Lessons Learned from the North Bay Fire Siege.” Proponents of the measure include Representative of California’s 2nd Congressional district Jared Huffman, President of the Marin Conservation League Linda J. Novy, and Marin County Fire Chief Jason Weber.

Opponent Michael Hartnett, treasurer of the Marin Public Policy Institute, claims Marin will receive $25 million in taxes this year and that the county should prioritize current revenue towards fire prevention instead of raising additional taxes. Hartnett also asserts Marin’s fire department is already well funded.

The opposition is also concerned over the legality of the measure. The 1978 Proposition 13 bans parcel taxes based on the property’s value. This was upheld in 2010 by the California First Circuit of the Court of Appeals when they ruled a parcel tax by the Alameda Unified School District invalid, making the decision case law.

Alameda’s parcel tax charged residents and owners of small commercial properties $120 per parcel. In contrast, they charged commercial properties of over 2,000 square feet, only 15 cents.

Measure C has a similar parcel tax, ten cents per building square foot, except for multifamily units. The precedent set by the Alameda Unified School District case could lead to Measure C being ruled unconstitutional under a Proposition 13 violation.

Prop. 13 – Didn’t Pass Statewide, Passed in Marin

Majority needed – 57% Yes in Marin, but 56% No Statewide

Proposition 13 authorizes a $15 billion state bond for the repair, construction, and modernization of California preschools, K-12 schools, community colleges, and universities. According to the California Voter Guide, development for new academic facilities occurs when areas are growing in enrollment. The voter guide also states that modernization projects take place when a building’s components are old and a life-safety issue is identified, like mold or asbestos.

The proposition will prioritize funding for schools in need of safety renovation, scholarships for students facing financial hardships, and school programs that use unionized labor, like the Canteen at Drake. It also gives local school districts the ability to increase funding by raising property taxes.

The money is split, with six billion dollars evenly distributed among Universities of California (UC), California State Universities (CSU), and community colleges. The other nine billion dollars will go to grade schools: $5.2 billion of that allocated for renovations, $2.8 billion for new construction projects, and the last $1 billion split between technical and charter schools. This bond comes with $11 billion of interest, with an annual payment of $740 million scheduling the principle and interest to be paid off in 35 years.

It is important to note that this Prop. 13 is different from the measure of the same name passed in 1978, decreasing property taxes in California by forbidding it to be raised by no more than two percent annually.